Fuel your dreams,

fuel your financial future.

Gain clarity. Build confidence. Obtain control.

No shame. No judgment. Just a clear plan that works.

Be honest with yourself for a moment…

- • Do you ever feel like you’re doing everything you can, but still living paycheck to paycheck?

- • Is revolving debt quietly draining your energy and peace of mind?

- • Does it feel like no matter how hard you try, you just can’t seem to get ahead?

If any of this sounds familiar, take a breath — there is a path forward, and you’re closer to it than you think.

Personal coaching + practical tools

Why I Coach

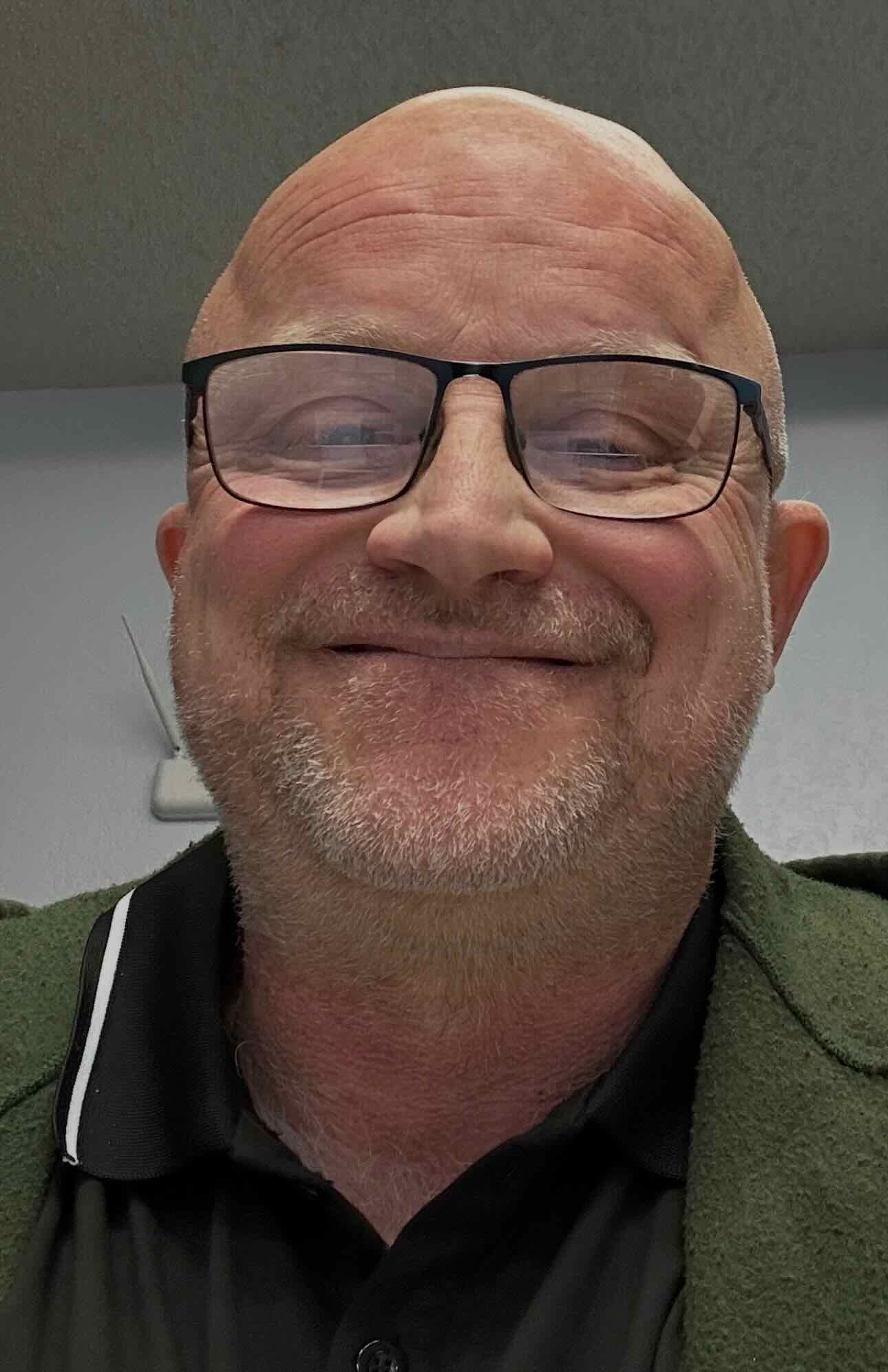

Welcome to Premier Financial Coaching. My name is Sean, and I’m a financial coach who helps people gain clarity, confidence, and control over their money. My passion for coaching comes from real-world experience, not theory. I’ve faced significant challenges in my life, including a period when I had to rebuild myself from the ground up. Seven years ago I had $500 to my name. I learned firsthand what it means to start over, fight for stability, and pursue a better future.

Seven years later, my life has transformed. I’ve built stability, purchased a home, paid off my car, and created a life built on purpose and direction. I share these same tools and principles with my clients because I know they work in real life—not just on paper. If you’re ready to move forward, I’m here to help you take the next step with a clear plan, genuine encouragement, and real accountability.

- Follow a step-by-step plan instead of guessing your next move.

- Understand your current spending habits without judgment.

- Create a practical budget that still feels like your life.

- Track your progress inside a simple web app between sessions.

- Increase your net worth by attacking debt and building assets.

Hi, I’m Sean — your financial coach.

A simple path out of debt and into wealth

We walk through each Baby Step together and plug your real numbers into the plan so you always know exactly where you are and what’s next.

Build a small starter emergency fund as fast as possible so surprise expenses don’t knock you off track.

Use a focused debt payoff strategy to crush consumer debt and free up your income.

Build 3–6 months of expenses in savings so life’s storms don’t become financial disasters.

Start investing a portion of your income for retirement so your future self is taken care of.

Plan ahead so your kids can pursue education without being buried in loans.

Attack your mortgage so you can live completely debt-free and build wealth faster.

With everything paid for, you’re free to build serious wealth and live a life of generosity.

A web-based app that shows where you’re heading

I've built a simple, yet powerful app just for my coaching clients. We'll use it to track your net worth, project your future based on your current spending, and then redesign that future by changing your habits—one pay period at a time.

- Track every asset and every debt to see your true net worth.

- Create a custom plan to pay off debt using the 7 Baby Steps.

- Project your future using your current spending and saving habits.

- Run “what if” scenarios to see how changes today impact tomorrow.

- Celebrate milestones as your net worth grows from negative to positive to thriving.

You don’t have to wonder if it’s working—you’ll see your progress in real numbers with real dates.

Coaching that connects your habits to your dreams

You’re not just hiring a money guy—you’re inviting a coach into your story. Together we’ll define your dreams, understand your current spending, and build a plan so you have more money left over at the end of every pay period.

- One-on-one video or phone sessions

- Custom Baby Step roadmap

- Net worth tracking in the app

- Accountability between paychecks

Schedule a call or send a message

The fastest way to get started is to schedule a complimentary 30-minute consultation. If you’d rather reach out with a question first, you can send a message instead—whatever helps you take the next step.

Complimentary 30-minute consultation

Choose a time that works best for you. We’ll talk about where you are, where you want to be, and whether coaching is a good next step for your situation.

Prefer to send a message first?

Use this form to ask a question or tell me a bit about your situation. No pressure, no commitment—just a safe place to get clarity before booking a consultation.

What happens after you reach out?

1. I’ll respond personally to confirm your complimentary consultation time or answer your questions.

2. We’ll meet online or by phone to talk through your current situation, your spending habits, and your dreams for the future.

3. You decide whether to move forward with a coaching package and access to the app. Either way, you’ll leave the call with more clarity and a next step.

This is a judgment-free zone. I’ve made mistakes too. The goal isn’t perfection—it’s progress, one Baby Step at a time.